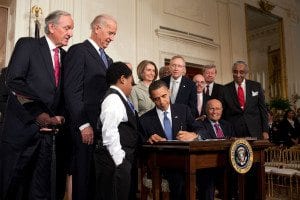

” If you got health coverage through President Barack Obama’s law this year, you’ll need a new form from your insurance exchange before you can file your tax return next spring.

Some tax professionals are worried that federal and state insurance marketplaces won’t be able to get those forms out in time, creating the risk of delayed tax refunds for millions of consumers.

The same federal agency that had trouble launching HealthCare.gov last fall is facing the heaviest lift.

The Health and Human Services Department must send out millions of the forms, which are like W-2s for people getting tax credits to help pay health insurance premiums.

The form is called a 1095-A, and it lists who in each household has health coverage and how much the government paid each month to subsidize their premiums. Nearly 5 million people have gotten subsidies through HealthCare.gov.”

You are here: