If you’re among the roughly 20 million people affected by the Affordable Care Act — either because you bought insurance through health exchanges or will be subject to penalties or exemptions for failing to get coverage — filing a tax return just got a lot harder. Indeed, potentially millions of people who never before had to file tax returns will now need to file as the result of the health law.

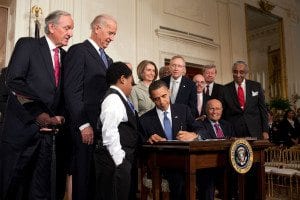

The ACA, better known as Obamacare, has put health insurance in reach for millions of Americans by setting up subsidies for those who otherwise couldn’t afford to buy coverage. However, the subsidies that may appear to simply lower the cost of insurance premiums are actually “advance premium tax credits” that are paid directly to health insurers.