Before the passage of ObamaCare’s 2,400 pages of coercive mandates and profligate spending, the federal government had already largely wrecked the market for individually purchased insurance, in three interconnected ways.

First, it had effectively established two different health insurance markets—employer-based and individually purchased—by treating them differently in the tax code. Second, it had given an attractive tax break for employer-based insurance while denying it for individually purchased insurance (except for the self-employed). Third, having effectively split the market in two while favoring the employer-based side, it had made it hard for people to move from the employer-based market to the individual market, as it had allowed insurers to treat previously covered conditions as “preexisting.”

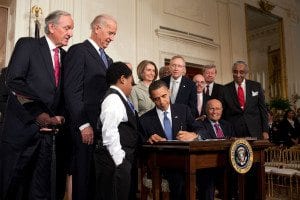

A popular conservative alternative, then, would repeal every word of ObamaCare while fixing this longstanding inequity in the tax code.

. . .