“Legal challenges to various aspects of Obamacare (aka the Affordable Care Act) keep traveling on a rollercoaster. Today’s episode of the law’s continuing courtroom soap opera involves a ruling by a federal district court in Oklahoma, which overturned a 2012 IRS rule authorizing premium assistance tax credits in federal exchanges (since rebranded as “federally facilitated marketplaces”). The decision improves the likelihood that the Supreme Court ultimately will consider this issue on appeal; either in the spring of 2015 or during its next 2015-2016 term.

Judge Ronald White ruled in State of Oklahoma v. Burwell that the IRS rule is “arbitrary, capricious, an abuse of discretion not in accordance with law, pursuant to 5 U.S.C. section 706(2)(A), in excess of statutory jurisdiction, authority, or limitations, or short of statutory right, pursuant to 5 U.S.C. section 706(2)(C), or otherwise is an invalid implementation of the ACA, and is hereby vacated.”

In other words, it was not just a “bad idea,” but an illegal one, too.”

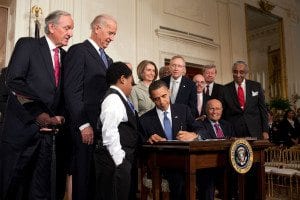

As the courts turn: The continuing legal perils of Obamacare

You are here: